Annuities Explained: Key Income Features and How to Make Sense of Them

Planning for retirement can feel overwhelming, especially when it comes to understanding annuities. These financial products are designed to provide steady income, but their rules and features can sometimes seem complex. To better assist clients in understanding these nuances, Annuities Genius offers a new Annuity Navigator feature. This tool simplifies the process by providing easy-to-understand comparisons and insights, ensuring clients can make informed decisions confidently. Below, we’ll break down some essential aspects of annuities and how this new feature can help streamline the decision-making process.

Account Value vs. Income Payments

One of the first things to understand is the difference between account value and income payments. Some annuities come with a guaranteed income rider that ensures payments continue even if the account value falls to zero.

- How It Works:

As clients withdraw money, the account value decreases over time. However, thanks to the rider, guaranteed income payments can continue for life, ensuring that the client will receive income even after the account balance is exhausted.

This unique structure makes annuities appealing to those concerned about outliving their retirement savings—a scenario that clients often worry about.

Lifetime Income Riders: Securing Steady Income for Life

Many annuities offer lifetime income riders, providing a way to lock in regular payments regardless of how long the client lives. This feature is a game-changer for retirees, offering income stability even when other assets may deplete.

- Why It’s Important:

Lifetime income riders protect against one of the biggest fears in retirement: running out of money. With this rider in place, the client will receive payments even if the account value reaches zero. Platforms like Annuities Genius make it easy to compare different lifetime income riders and show clients exactly how these products work.

The Annuity Navigator feature lets you compare products side by side, helping clients understand how different lifetime income riders function and which ones best suit their needs.

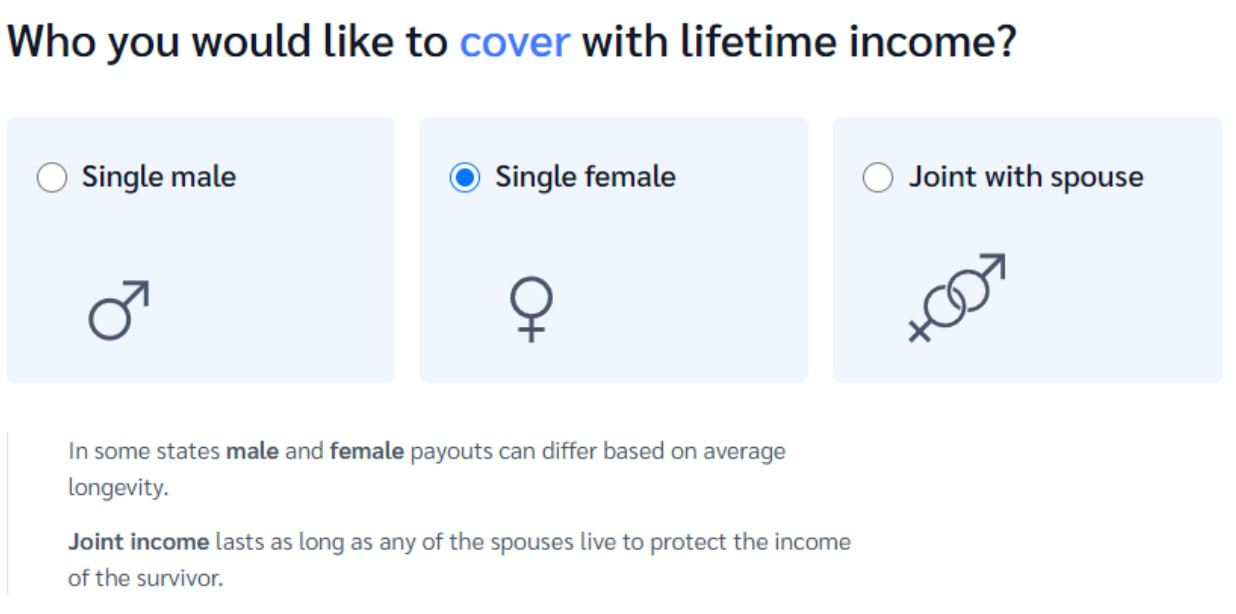

Joint Withdrawals: Protecting Couples’ Financial Security

For married couples, annuities often provide joint withdrawal options, which ensure that income continues even after one partner passes away.

- What Clients Should Know:

When choosing a joint withdrawal option, both spouses receive income payments for their lifetimes. Depending on the product, the payout amount may remain the same or adjust slightly upon the first partner’s death. This feature provides peace of mind, ensuring the surviving spouse won’t face financial hardship.

Managing Withdrawals: A Balancing Act

While annuities provide steady income, clients should understand that withdrawals impact the account value. If they withdraw more than the income amount allowed by the annuity, they may reduce the account balance faster than expected.

- Why This Matters:

It’s important to plan withdrawals carefully to make the account value last longer. Tools like Annuities Genius allow you to run different scenarios for your clients, demonstrating how varying withdrawal rates affect their overall plan. This helps clients avoid over-withdrawing and ensures their investment lasts throughout retirement.

Using Annuities Genius to Simplify Complex Decisions

Explaining the nuances of annuities to clients can be time-consuming and challenging. This is where Annuities Genius shines—it offers a user-friendly way to compare annuities side-by-side, explore income riders, and model withdrawal strategies.

How It Helps

- Quickly identify the best annuity products based on client needs.

- Compare income riders and joint withdrawal options with ease.

- Model withdrawal scenarios to show clients the long-term impact on their account value.

A Reliable Income Stream for Retirement

Annuities offer a powerful way to secure income throughout retirement, even if the account balance is depleted. With lifetime income riders and joint withdrawal options, clients can feel confident about their financial future. However, understanding these features can be daunting.

With the right tools, such as the Annuity Navigator, advisors can simplify the decision-making process for clients, helping them understand and compare income riders, joint withdrawal options, and withdrawal strategies.

Annuities are more than just financial products—they're a safety net for your clients' future. With tools like Annuities Genius, you can simplify your consultations and ensure your clients fully understand their options, helping them make well-informed decisions for a worry-free retirement.