Income Rider VS Growth Analyzer

Last week, we took an in-depth look at the Income Rider Calculator, how it works, and how it makes your job as an agent easier — but we really only scratched the surface of how POWERFUL this tool really is.

In addition to being an amazingly simple way to create PERSONALIZED income rider reports for your client, our Income Rider Calculator integrates seamlessly with other tools included in the Genius like our Growth Analyzer and our Index Indicator. Together, these three tools create a trifecta that makes life as an agent a breeze.

In this blog post, we’ll cover both the Growth Analyzer and Income Rider Calculator so you can help your clients choose the option that's best for them. Some may be looking for their money to grow as much as possible, while other maybe looking for best income output.

HYPOTHETICAL CASE STUDY; INCOME RIDER VS. GROWTH

In this hypothetical case study, we'll be using the income rider calculator to determine guaranteed income for your clients, and how you can adjust deferments or solve for income premiums.

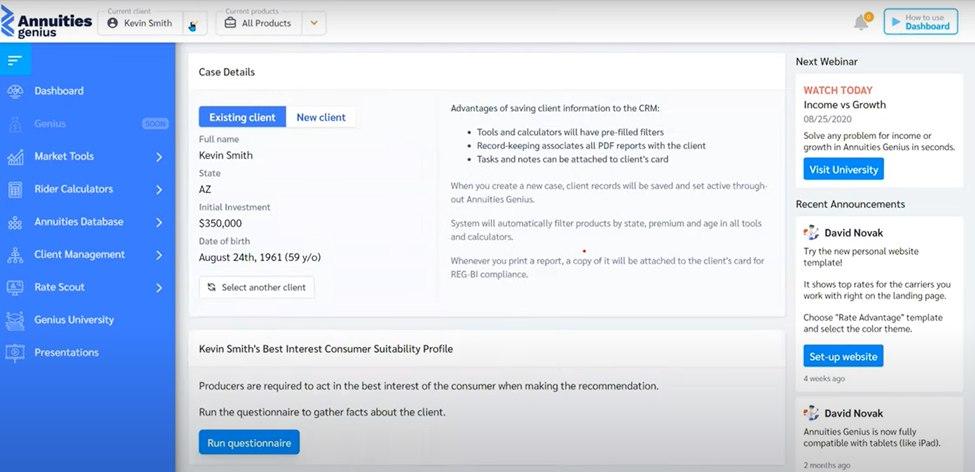

CREATE A CLIENT

The first step of pretty much any process using the genius would be to Create a Client and that’s as simple as entering your client’s information. It will be saved to the included CRM and the Genius will also save all reports generated for that client to keep you both organized and compliant. The Genius will also filter out results according to the specific parameters you set in your client’s profile.

Let’s say our client, “Kevin Smith”, is retiring in 7 years. “Kevin” has $350,000 to invest and is 59 years old.

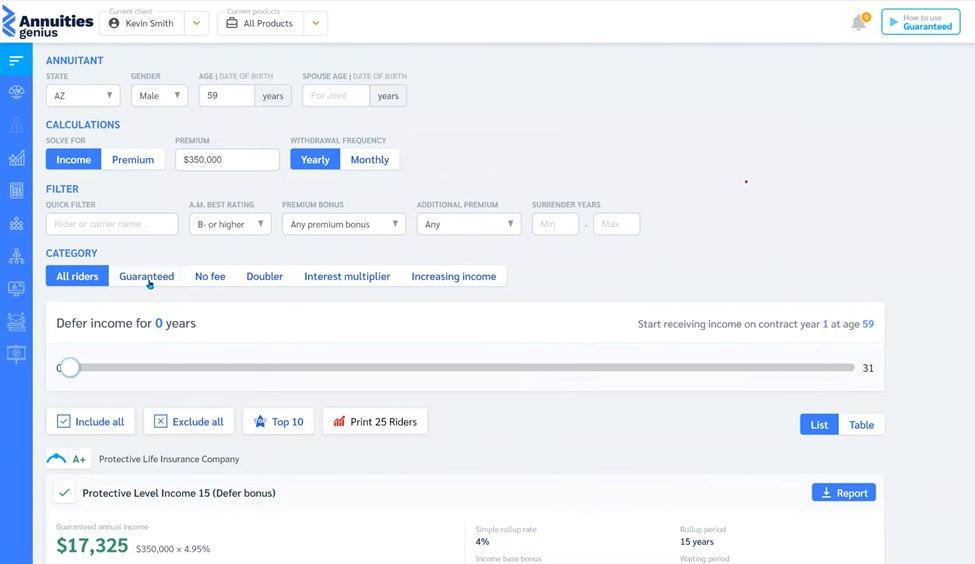

SOLVING FOR GUARANTEED INCOME USING THE RIDER CALCULATOR

“Kevin” wants to begin his living benefit withdrawals at age 66. Once his information, parameters, and filters are chosen in the rider calculator; the Genius will AUTOMATICALLY populate a list of products that meet his specific needs.

(If you really want to impress your client, you can do all of this right in front of them! They’ll be amazed at how efficient the genius is — especially if they’ve already spoken to other agents that need extra time to research.)

So, now you’ve got a personalized list of products for “Kevin” BUT he’s not happy with the annual payout.

Before Annuities Genius, you’d literally go back to the drawing board—basically start from the beginning OR heading home to run some numbers to bring them back on another day.

Luckily, you don’t have to do that anymore. The Genius has your back.

- In the details on your client specific report, you can SEE AND SHARE the results of a longer deferral period OR higher premium.

- From the detailed report, you can determine desired income, and then go back and change the settings on the Income Rider Calculator.

Say “Kevin” wants an annual income of $40,000 a year and your initial report for him is only offering products in the $30K range. What will you do?!

- You can go back to solve for premium, enter that desired income, and the reports below will reflect the premiums need to reach his goal.

- You can choose the reports that meet his specific needs and go over them together virtually, or even print them out for recordkeeping and transparency.

BUT THAT’S NOT ALL… From here, you can go straight to the illustrations!

Isn’t that incredible? Annuities Genius helps you keep everything in one place. You don’t have to switch sites, make phone calls, and leave “Kevin” waiting. You can pull up illustrations on the spot.

So that’s exactly what you’ll do.

With just a few clicks, you’ll have a COMPLETE illustration for your client that includes a full product breakdown, both guaranteed and hypothetical values, and index performance.

That’s it! You’ve helped “Kevin” choose the product that’s right for him, and you did it in less time than it took to read this article.

BUT WE’RE NOT FINISHED!

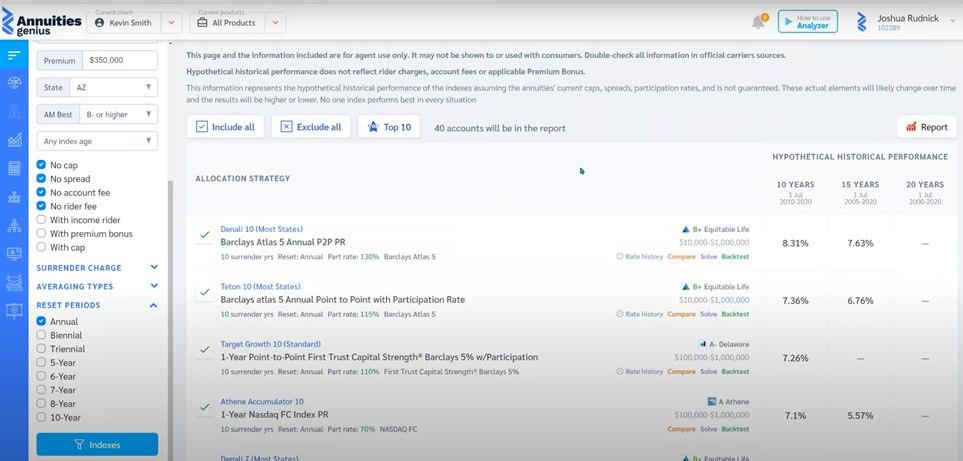

SOLVING FOR GROWTH USING THE GROWTH ANALYZER

“Kevin” really needs to settle into a $40K+ annual income BUT he doesn’t have anything to add to his premium. Obviously, you want to give “Kevin” what he wants, act in his very Best Interest and still close the deal.

With the same ease and transparency of the Income Rider Calculator, you can quickly show “Kevin” his growth options using the Growth Analyzer. Can you an index that’s been performing well enough historically to offer “Kevin” both what he wants and peace of mind?

Of course you can! Enter Growth Analyzer.

- Choose your mode, filters, surrender charges, index ages, caps, spreads, and any fees.

- Once you’ve made all the choices with your client, and educated them on the specifics, you’ll have the top 40 options in front of you with the click of a button!

- From here you can print out a report of your client’s best options and start to compare.

SIDE-BY-SIDE REPORTS

You also have the option with Annuities Genius to compare side-by-side virtually!

You can also quickly back test, research rate history, and solve—which links directly to our FIA solver tool.

Simply choose the product and the index, select the withdraw age and premium amount, and FIA solver tool will show you the best case scenario.

Again, just like with the Income Rider Calculator, you can solve for desired income or premium. You may even be able to offer “Kevin” something that meets his needs with a much lower premium.

KEY TAKEAWAYS

- Annuities Genius makes solving for Income or Growth fast and simple!

- You have the ability to work WITH your clients to make important decisions

- Our income rider calculator helps you solve for desired income

- Illustrations are available at the click of a button!

- Our growth analyzer helps agents get the most for their clients

- Side-by-side reporting helps agents and client’s compare benefits

- Some clients may need the rider calculator and growth analyzer, we have them both in the same place!

And it’s really just a few clicks of a button!

Using Annuities Genius WITH your clients really will revolutionize the way you do business.