Preparing for the DOL Fiduciary Rule in Annuities World

At Annuities Genius, we have always championed transparency, trust, and compliance in the annuity selection process. Our commitment is to a client-centric approach, providing the necessary tools and information for:

- Qualifying clients

- Developing strategies where annuities are either a solution or part of one

- Quoting annuities for various purposes

- Comparing suitable annuities in detail

- Ultimately selecting a product that best serves the client's interests

There is a significant regulatory change looming in the financial industry: the Department of Labor (DOL) Fiduciary Rule. This rule, if implemented, will specifically impact how annuity agents operate.

Understanding the New Rule

First and foremost, agents must thoroughly understand the new rule. It broadens the scope of fiduciary duty to include any financial advice regarding retirement plans and IRAs. This means agents offering annuities to retirement savers will be considered fiduciaries and must act in the best interests of their clients.

Documentation and Disclosure

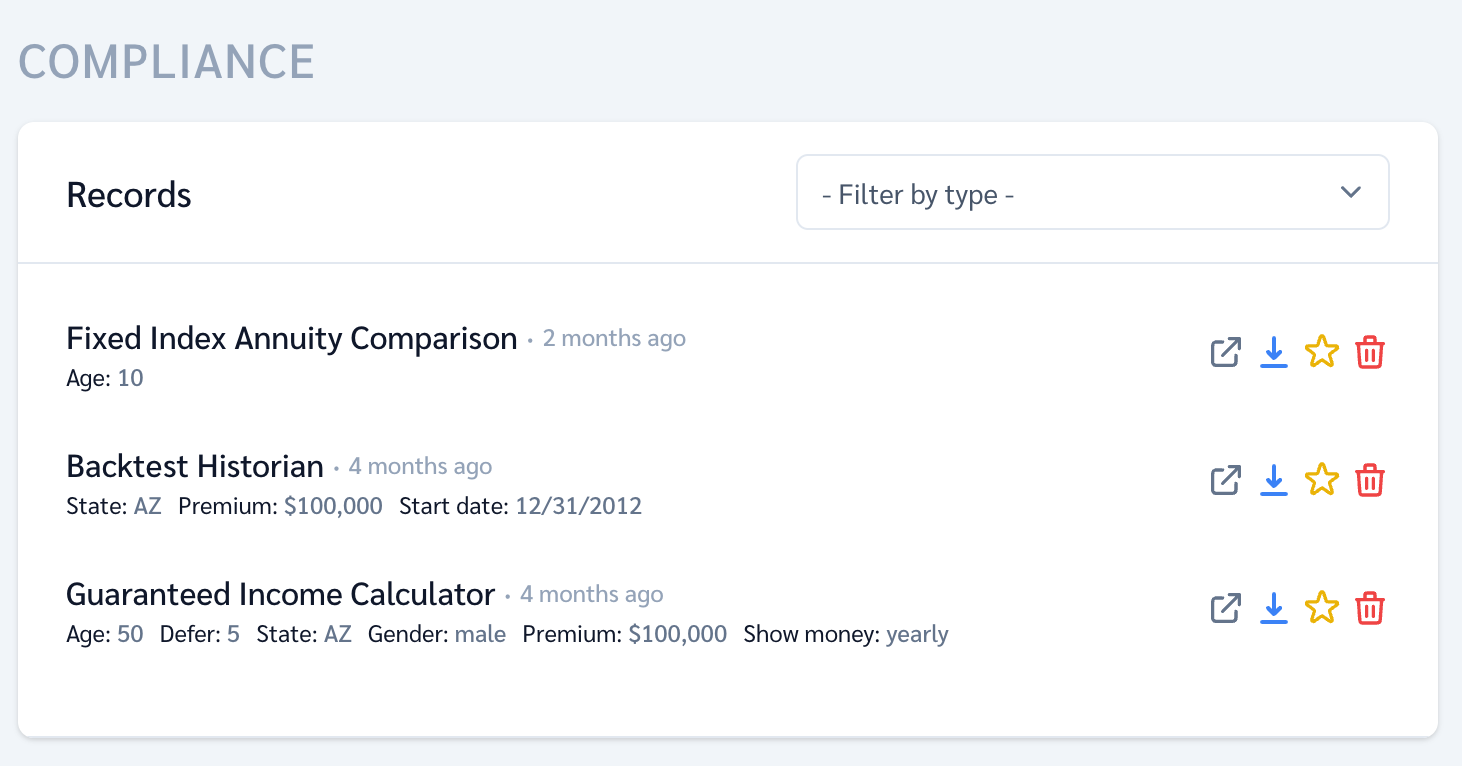

Maintaining comprehensive records is more important than ever. Agents should document their advisory processes, client interactions, and the rationale behind each recommendation.

Technological Tools

Investing in technology can aid compliance. Customer Relationship Management (CRM) systems, compliance software, and other tech tools can streamline documentation, ensure consistent application of policies, and facilitate client communications.

Changes Within Annuities Genius

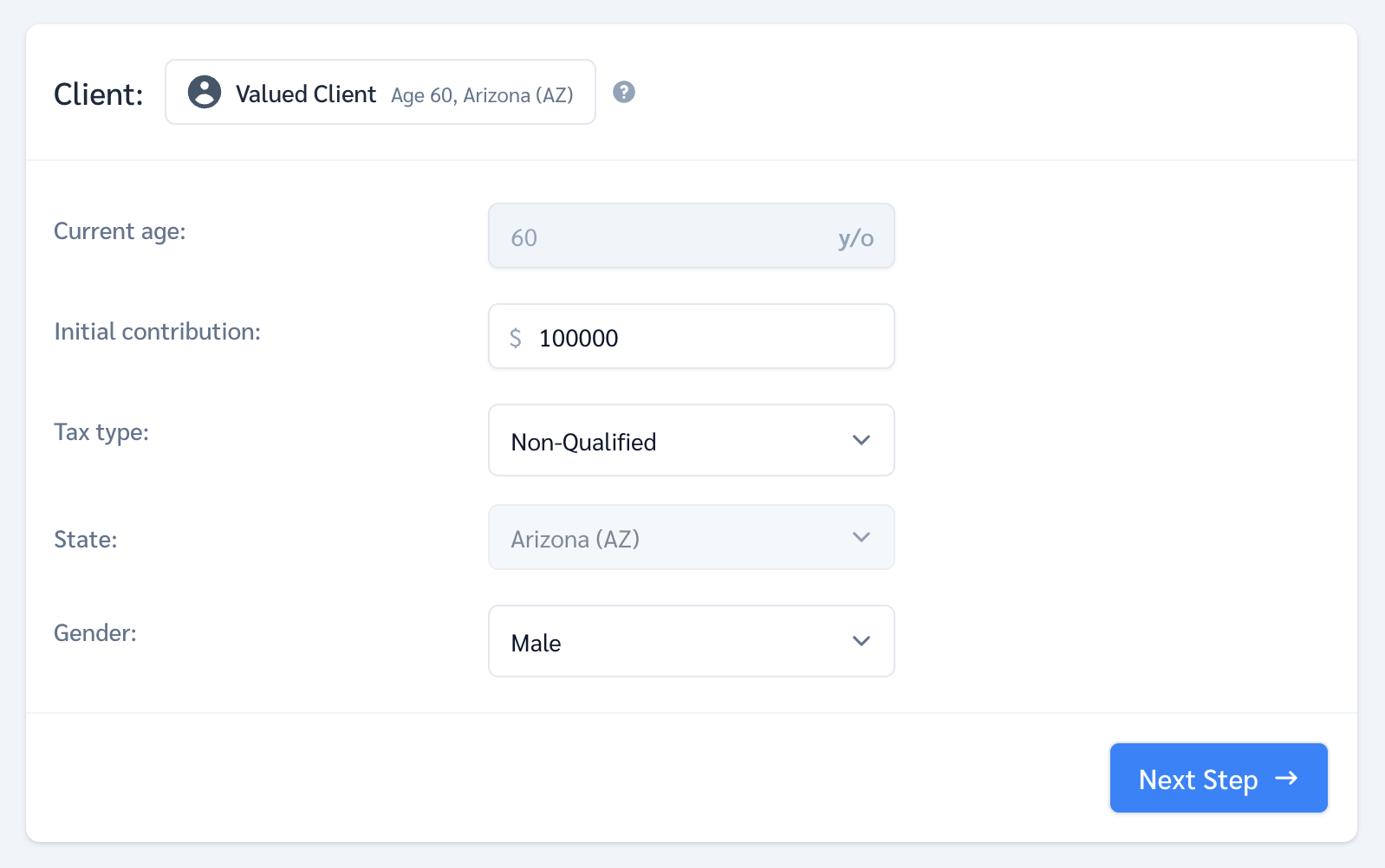

Our software embodies a client-centric approach. Every quoting tool now operates within the context of a specific client, enhancing both functionality and compliance.

Key compliance foundations are ensured through this update:

- All generated reports are stored in the client's profile for a minimum of five years.

- It becomes easy to prove thorough research and adherence to the client's best interests.

- Clients experience a personalized approach, fostering trust in the process.

Moreover, this alteration paves the way for novel forms of interaction. These include directly sending reports to a client's email or phone, engaging in client chats, and more.